Explore our suite of convenient Online and Mobile solutions.

Press Releases

Want to know what's new with us? Here's where you'll find the latest news about events, services and much more.

- Home

- About

- Explore C&N

- Press Releases

- 2021 Q3

- C&N Declares Dividend and Announces Second Quarter 2021 Unaudited Financial Results

07/22/2021

C&N Declares Dividend and Announces Second Quarter 2021 Unaudited Financial Results

Wellsboro, PA – Citizens & Northern Corporation (“C&N”) (NASDAQ: CZNC) announced its most recent dividend declaration and its unaudited, consolidated financial results for the three-month and six-month periods ended June 30, 2021.

Dividend Declared

On July 22, 2021, C&N’s Board of Directors declared a regular quarterly cash dividend of $0.28 per share. The dividend is payable on August 13, 2021 to shareholders of record as of August 2, 2021.

Unaudited Financial Information

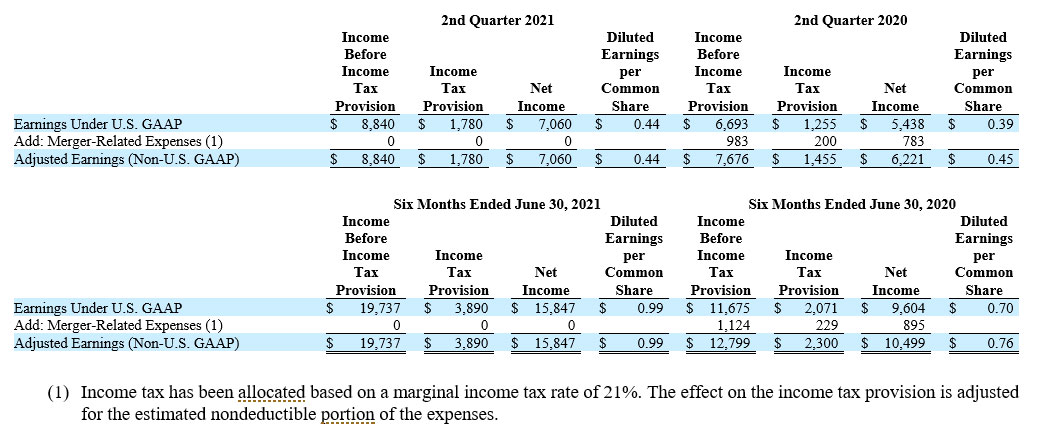

Net income was $0.44 per diluted share in the second quarter 2021, down from $0.55 in the first quarter 2021 and up $0.05 (12.8%) from $0.39 in the second quarter 2020. For the six months ended June 30, 2021, net income per diluted share was $0.99, up from $0.70 per share for the first six months of 2020. As described below, earnings of $0.44 per share for the second quarter 2021 were 0.2% lower than second quarter 2020 non-U.S. generally accepted accounting principles (U.S. GAAP) earnings per share of $0.45 as adjusted to exclude the impact of merger-related expenses. For the six months ended June 30, 2021, earnings of $0.99 per share were 30.3% higher than the first six months of 2020 non-U.S. GAAP earnings per share of $0.76 as adjusted to exclude the impact of merger-related expenses.

The following table provides a reconciliation of C&N’s unaudited earnings results under U.S. GAAP to comparative non-U.S. GAAP results excluding merger-related expenses. Management believes disclosure of unaudited earnings results for the periods presented, adjusted to exclude the impact of these items, provides useful information to investors for comparative purposes.

RECONCILIATION OF UNAUDITED U.S. GAAP NET INCOME AND

DILUTED EARNINGS PER SHARE TO NON-U.S. GAAP MEASURE

(Dollars In Thousands, Except Per Share Data)

(Unaudited)

Acquisition of Covenant Financial, Inc.

On July 1, 2020, C&N completed its acquisition of Covenant Financial, Inc. (“Covenant”). Covenant was the holding company for Covenant Bank, which operated banking offices in Bucks and Chester Counties of Pennsylvania. The Covenant acquisition has contributed significantly to growth in the size of C&N’s balance sheet and in net interest income and noninterest expenses.

Merger-related expenses related to the acquisition of Covenant totaled $983,000 in the second quarter 2020 and $1,124,000 in the six months ended June 30, 2020.

Highlights related to C&N’s second quarter and June 30, 2021 year-to-date unaudited U.S. GAAP earnings results as compared to the first quarter 2021 and the second quarter of 2020 are presented below.

Second Quarter 2021 as Compared to First Quarter 2021

Net income was $7,060,000, or $0.44 per diluted share, for the second quarter 2021 as compared to $8,787,000, or $0.55 per diluted share, in the first quarter 2021. Significant variances were as follows:

- Net interest income totaled $18,681,000 in the second quarter 2021, down $1,402,000 from the first quarter 2021 amount of $20,083,000. Significant variances included the following:

- Total interest and fees from loans originated under the U.S. Small Business Administration (SBA) Paycheck Protection Program (PPP) were $1,249,000 in the second quarter 2021, a decrease of $749,000 from the first quarter 2021 total. The decrease in income from PPP loans resulted from a reduction in volume of loans processed for the SBA’s repayment tied to the forgiveness of the underlying borrowers. Total fee income from PPP loans amounted to $921,000 in the second quarter 2021 (included in the $1,249,000 noted above) and $1,645,000 in the first quarter 2021.

- Accretion and amortization of purchase accounting adjustments had a net positive impact on net interest income of $713,000 in the second quarter 2021 as compared to a net positive impact of $952,000 in the first quarter 2021.

- Average loans outstanding totaled $1.607 billion in the second quarter 2021, down $27.5 million from the prior quarter, including a $13.1 million decrease in average PPP loans as well as decreases in other commercial loans and residential mortgage loans.

- Average total deposits increased $87.9 million, including an increase in average noninterest-bearing demand deposits of $50.3 million and average interest-bearing deposits of $37.6 million. Average total borrowed funds increased $3.4 million as new issuances of subordinated debt and senior notes increased $17.3 million and other average short-term and long-term borrowings decreased $13.9 million.

- The net interest rate spread decreased 0.49%, as the average yield on earning assets decreased 0.48% while the average rate on interest-bearing liabilities increased 0.01%. The net interest margin was 3.52% in the second quarter 2021, down from 4.00% in the first quarter 2021. In addition to other factors, the second quarter 2021 net interest margin was impacted by: (1) an increase in the average balance of lower-yielding interest-bearing deposits with the Federal Reserve and other banks of $90.0 million, to $182.6 million or 8.5% of average interest-earning assets, from 4.5% in the prior quarter; (2) a reduction in average loans to 74.5% of average earning assets as compared to 79.1% in the prior quarter; (3) a reduction in interest and fees on PPP loans, as an annualized percentage of average earning assets, to 0.23% in the second quarter 2021 from 0.39% in the prior quarter; and (4) a reduction in net interest income from purchase accounting adjustments to 0.13% of average earning assets in the second quarter 2021 from 0.19% in the prior quarter.

- The provision for loan losses was $744,000 in the second quarter 2021, an increase in expense of $485,000 from the first quarter 2021 provision of $259,000. The second quarter provision included a net charge of $383,000 related to specific loans (net increase in specific allowances on loans of $353,000 and net charge-offs of $30,000), an increase of $337,000 in the collectively determined portion of the allowance and a $6,000 decrease in the unallocated portion.

- Noninterest income was $6,300,000 in the second quarter 2021, down $482,000 from the first quarter 2021 amount. Significant variances included the following:

- Other noninterest income totaled $700,000, a decrease of $772,000 from the first quarter 2021 total including a decrease in income from tax credits of $765,000. Income from tax credits in the first quarter included 90% credits on the PA Educational Improvement Tax Credit Program donations noted below.

- Net gains from sales of loans totaled $925,000 in the second quarter 2021, a decrease of $139,000 from the first quarter 2021 total, reflecting a reduction in volume of residential mortgage loans sold.

- Loan servicing fees, net, were $146,000 in the second quarter 2021 as compared to $248,000 in the first quarter 2021. The fair value of mortgage servicing rights decreased $39,000 in the second quarter as compared to a $75,000 increase in the first quarter.

- Trust revenue of $1,807,000 increased $181,000 from the first quarter 2021 total, reflecting the impact of growth in trust assets under management including the impact of market value appreciation.

- Brokerage and insurance revenue of $506,000 increased $180,000 from the first quarter 2021 total, due to commissions on higher transaction volume.

- Interchange revenue from debit card transactions of $998,000 increased $117,000 from the first quarter 2021 total, as transaction volume increased over the quarter.

- Noninterest expense of $15,399,000 decreased $310,000 in the second quarter 2021 from the first quarter 2021 amount. Significant variances included the following:

- Other noninterest expense of $1,751,000 decreased $1,004,000 from the first quarter 2021 total, including a decrease in donations expense of $803,000. In the first quarter 2021, donations under the PA Educational Improvement Tax Credit Program totaled $800,000.

- Salaries and employee benefits of $9,499,000 increased $604,000 from the first quarter 2021 total, including increases in lending and information technology personnel, severance and estimated incentive compensation expense, partially offset by a cyclical reduction in payroll taxes and other benefit expenses.

- Data processing and telecommunications of $1,487,000 increased $107,000 from the first quarter 2021 total, including increases in software maintenance and subscription expenses.

- The income tax provision was $1,780,000 for the second quarter 2021, down from $2,110,000 for the first quarter 2021, consistent with lower pre-tax income.

Second Quarter 2021 as Compared to Second Quarter 2020

As described above, second quarter 2021 net income was $7,060,000. In comparison, second quarter 2020 net income was $5,438,000, and excluding merger-related expenses, adjusted (non-U.S. GAAP) earnings were $6,221,000. Other significant variances were as follows:

- Second quarter 2021 net interest income of $18,681,000 was $4,435,000 higher than the second quarter 2020 total, reflecting the impact of growth mainly attributable to the Covenant acquisition. Average outstanding loans increased $375.7 million, and average total deposits increased $569.9 million. The net interest margin for the second quarter 2021 was 3.52% as compared to 3.65% for the second quarter 2020. The average yield on earning assets of 3.85% for the second quarter 2021 was down 0.37% from the second quarter 2020, while the average rate on interest-bearing liabilities of 0.48% in the second quarter 2021 was 0.35% lower than the comparable second quarter 2020 average rate. Accretion and amortization of purchase accounting adjustments had a net positive impact on net interest income of $713,000 in the second quarter 2021 as compared to a net positive impact of $285,000 in the second quarter 2020.

- The provision for loan losses was $744,000 in the second quarter 2021 as compared to a credit for loan losses of $176,000 in the second quarter 2020. Details concerning the second quarter 2021 provision for loan losses were described previously. The credit for loan losses in the second quarter 2020 included the benefit of repayment of a loan for less than the full principal balance, resulting in a charge-off of $107,000 on a commercial loan for which an allowance for loan losses of $674,000 had been recorded at March 31, 2020.

- Noninterest income for the second quarter 2021 was up $772,000 from the second quarter 2020 total. Significant variances included the following:

- Loan servicing fees, net, were $146,000 in the second quarter 2021, an increase of $304,000 over the second quarter 2020 reduction in revenue of $158,000. The fair value of servicing rights decreased $39,000 in the second quarter 2021 as compared to a reduction in fair value of $270,000 in the second quarter 2020.

- Interchange revenue from debit card transactions totaled $998,000 in the second quarter 2021, an increase of $280,000 over the second quarter 2020 total.

- Service charges on deposit accounts of $1,073,000 in the second quarter 2021 were up $242,000 from the second quarter 2020 amount, as the volume of consumer and business overdraft activity increased.

- Trust revenue of $1,807,000 increased $242,000 reflecting the impact of growth in trust assets under management including the impact of market value appreciation.

- Other noninterest income totaled $700,000, an increase of $174,000 from the second quarter 2020. In the second quarter 2021, fee income for providing credit enhancement on sale of mortgage loans increased $45,000, credit card interchange income increased $41,000, merchant services income increased $28,000 and income from a full-service title agency acquired from Covenant increased $26,000.

- Brokerage and insurance revenue of $506,000 increased $122,000 from the second quarter 2020 total, due to commissions on higher transaction volume.

- Net gains from sales of loans of $925,000 for the second quarter 2021 were down $639,000 from the total for the second quarter 2020, as the volume of residential mortgage loans sold in the second quarter 2021 was down from the second quarter 2020 level.

- Noninterest expense, excluding merger-related expenses, increased $3,125,000 in the second quarter 2021 over the second quarter 2020 amount. Significant variances included the following:

- Salaries and employee benefits of $9,499,000 increased $2,516,000, reflecting an increase in personnel primarily from the Covenant acquisition.

- Net occupancy and equipment expense increased $244,000, primarily reflecting an increase due to the Covenant acquisition.

- Data processing and telecommunications expenses increased $234,000, including the impact of growth related to the Covenant acquisition, increased costs from outsourced support services and other increases in software licensing and maintenance costs.

- The income tax provision of $1,780,000 for the second quarter 2021 was up $525,000 from $1,255,000 for the second quarter 2020, reflecting higher pre-tax income and an increase in city of Philadelphia and state tax provisions.

Six Months Ended June 30, 2021 as Compared to Six Months Ended June 30, 2020

Net income for the six-month period ended June 30, 2021 was $15,847,000, or $0.99 per diluted share, while net income for the first six months of 2020 was $9,604,000, or $0.70 per share. Excluding the impact of merger-related expenses, adjusted (non-U.S. GAAP) earnings for the first six months of 2020 would be $10,499,000 or $0.76 per share. Other significant variances were as follows:

- Net interest income was up $10,236,000 (35.9%) for the first six months of 2021 over the same period in 2020, reflecting the growth mainly attributable to the Covenant acquisition. Average outstanding loans increased $420.8 million, and average total deposits increased $570.6 million. The net interest margin was 3.75% for the six months ended June 30, 2021, up from 3.73% for the first six months of 2020. Accretion and amortization of purchase accounting adjustments had a net positive impact on net interest income of $1,665,000 in the first six months of 2021 as compared to a net positive impact of $702,000 in the first six months of 2020.

- For the first six months of 2021, the provision for loan losses was $1,003,000, a decrease in expense of $349,000 as compared to $1,352,000 recorded in the first six months of 2020. The provision for the first six months of 2021 includes a net charge of $565,000 related to specific loans (increase in specific allowances on loans of $552,000 and net charge-offs of $13,000), an increase of $352,000 in the collectively determined portion of the allowance and an $86,000 increase in the unallocated portion. In comparison, the provision for loan losses in the first six months of 2020 included the effects of recording a specific allowance of $1,193,000 on a commercial loan for which a charge-off of $2,219,000 was subsequently recorded in the third quarter 2020.

- Noninterest income for the first six months of 2021 was up $2,273,000 from the total for the first six months of 2020. Significant variances included the following:

- Other noninterest income totaled $2,172,000, an increase of $585,000 over 2020. Income from realization of tax credits was $265,000 higher in the first six months of 2021 as compared to 2020 due to higher PA Educational Improvement Tax Credit Program donations. Other increases include: fee income for providing credit enhancement on sale of mortgage loans increased $144,000, income from a full-service title agency acquired from Covenant increased $73,000, credit card interchange income increased $69,000 and merchant services income increased $43,000.

- Loan servicing fees, net, were $394,000 in the first six months of 2021, an increase of $566,000 over the 2020 total of negative $172,000 (a decrease in revenue). The fair value of servicing rights increased $36,000 in the first six months of 2021 as compared to a reduction in fair value of $396,000 in 2020 mainly due to changes in assumptions related to prepayments of mortgage loans.

- Interchange revenue from debit card transactions totaled $1,879,000 for the first six months of 2021, an increase of $430,000, reflecting an increase in transaction volumes.

- Trust revenue of $3,433,000 increased $389,000 reflecting the impact of growth in trust assets under management including the impact of market value appreciation.

- Net gains from sales of loans totaled $1,989,000 in the first six months of 2021, an increase of $110,000 over the total for the first six months of 2020. The increase reflects an increase in volume of mortgage loans sold, resulting mainly from lower interest rates.

- Noninterest expense, excluding merger-related expenses, increased $5,922,000 for the six months ended June 30, 2021 over the total for the first six months of 2020. Significant variances included the following:

- Total salaries and wages and benefits expenses increased $4,033,000, reflecting inclusion of the former Covenant operations in 2021.

- Other noninterest expense increased $496,000. Within this category, significant variances included the following:

- Donations expense increased $232,000, mainly due to an increase in donations associated with the PA Educational Improvement Tax Credit program.

- Business development expenses totaled $260,000, an increase of $169,000, due primarily to an increase in public relations expense.

- FDIC insurance expense totaled $275,000, an increase of $162,000.

- Amortization of core deposit intangibles increased $143,000 related to the Covenant acquisition.

- Other operational losses totaled $149,000, a decrease of $195,000. Expenses associated with trust department tax compliance matters totaled $107,000 in the first six months of 2021 as compared to $300,000 in the first six months of 2020.

- Net occupancy and equipment expense increased $445,000, primarily reflecting an increase due to the Covenant acquisition.

- Data processing and telecommunications expenses increased $390,000, including the impact of growth related to the Covenant acquisition, increased costs from outsourced support services and other increases in software licensing and maintenance costs.

- Professional fees expense increased $302,000, mainly due to increases in recruiting services and PPP loan processing professional fees.

- The income tax provision was $3,890,000 for the six months ended June 30, 2021, up from $2,071,000 for the first six months of 2020. Pre-tax income was $8,062,000 higher in the first six months of 2021 as compared to 2020. The effective tax rate was 19.7% for the first six months of 2021, higher than the 17.7% effective tax rate for the first six months of 2020. The tax benefit of tax-exempt interest income was 2.3% of pre-tax income in the first six months of 2021 as compared to a 3.3% benefit in 2020. Also, city and state income taxes, net of federal benefit, totaled 1.6% of pre-tax income in the first six months of 2021, up from 0.7% in 2020.

Other Information:

Changes in other unaudited financial information are as follows:

- Total assets amounted to $2,339,063,000 at June 30, 2021, up from $2,333,595,000 at March 31, 2021 and up 34.0% from $1,745,466,000 at June 30, 2020.

- Net loans outstanding (excluding mortgage loans held for sale) were $1,585,481,000 at June 30, 2021, down from $1,602,926,000 at March 31, 2021 and up 28.9% from $1,230,387,000 at June 30, 2020. Loans outstanding, excluding PPP loans, totaled $1,487,545,000 at June 30, 2021, an increase of $10,793,000 from total loans excluding PPP at March 31, 2021. In comparing outstanding balances at June 30, 2021 and 2020, total commercial loans were up $326.7 million (49.6%), including PPP loans of $110.3 million, total residential mortgage loans were higher by $29.6 million (5.2%) and total consumer loans were up $0.1 million (0.9%). The outstanding balance of residential mortgage loans originated and serviced by C&N that have been sold to third parties was $314.2 million at June 30, 2021, up $103.4 million (49.1%) from June 30, 2020.

- The recorded investment in PPP loans at June 30, 2021 of $110.3 million included a first draw amount of $37.9 million and a second draw amount of $72.4 million with contractual principal balances totaling $38.7 million and $75.4 million, respectively, adjusted by net deferred loan origination fees and a market rate adjustment on PPP loans acquired from Covenant. The recorded investment of $37.9 million in first draw PPP loans at June 30, 2021 decreased $33.8 million from $71.7 million at March 31, 2021, reflecting the impact of loans forgiven and repaid by the SBA. The term of the first draw PPP loans is two years, with repayment from the SBA to occur sooner to the extent the loans are forgiven. Second draw PPP loans have terms of five years, with repayment from the SBA to occur sooner to the extent the loans are forgiven.

- To work with clients impacted by COVID-19, C&N is offering short-term loan modifications (deferrals) on a case-by-case basis to borrowers who were current in their payments prior to modification. These loans are not reported as past due or troubled debt restructurings during the deferral period. At June 30, 2021, there were 12 loans, with an aggregate recorded investment of approximately $6.7 million, in deferral status under the program. In comparison, at March 31, 2021, C&N had 25 loans with an aggregate recorded investment of $26.0 million in deferral status. Within these totals, loans in deferral status to commercial borrowers in the hotel industry totaled $3.1 million at June 30, 2021 and $19.5 million at March 31, 2021.

- Total nonperforming assets as a percentage of total assets was 1.12% at June 30, 2021, as compared to 1.07% at March 31, 2021 and down from 1.33% at June 30, 2020. Total nonperforming assets were $26.2 million at June 30, 2021, up from $24.9 million at March 31, 2021 and $23.2 million at June 30, 2020.

- The allowance for loan losses was $12.4 million at June 30, 2021, or 0.77% of total loans as compared to $11.7 million or 0.72% of total loans at March 31, 2021. In 2020 and 2019, C&N recorded performing loans purchased from other financial institutions at fair value. The calculations of fair value included discounts for credit losses, reflecting an estimate of the present value of credit losses based on market expectations. The total allowance for loan losses and the credit adjustment on purchased non-impaired loans at June 30, 2021 was $16.9 million, or 1.05% of total loans receivable and the credit adjustment. The comparative ratios were 1.04% at March 31, 2021 and 0.96% at June 30, 2020.

- Deposits totaled $1,916,809,000 at June 30, 2021, down from $1,923,925,000 at March 31, 2021, and up 38.8% from $1,381,178,000 at June 30, 2020.

- Total stockholders’ equity was $304,133,000 at June 30, 2021, up from $300,056,000 at March 31, 2021 and $255,791,000 at June 30, 2020. The increase in stockholders’ equity from June 30, 2020 included the impact of common stock issued in July 2020 related to the Covenant acquisition. Within stockholders’ equity, the portion of accumulated other comprehensive income related to available-for-sale debt securities was $9,167,000 at June 30, 2021, up from $6,847,000 at March 31, 2021 and down from $11,472,000 at June 30, 2020. Fluctuations in accumulated other comprehensive income related to valuations of available-for-sale debt securities have been caused by changes in interest rates.

- In February 2021, C&N amended its existing treasury stock repurchase program. Under the amended program, C&N is authorized to repurchase up to 1,000,000 shares of the Corporation’s common stock, or 6.25% of the Corporation’s issued and outstanding shares at February 18, 2021. In the second quarter 2021, 61,696 shares were repurchased for a total cost of $1,531,000, at an average price of $24.81 per share. There were no repurchases of stock under the amended program in the first quarter 2021.

- In May 2021, C&N completed a private placement of $25 million of 3.25% Fixed-to-Floating Rate Subordinated Debt due 2031 and $15 million of 2.75% Fixed Rate Senior Unsecured Notes due 2026. The Subordinated Debt is intended to qualify as Tier 2 capital. In June 2021, a portion of the proceeds was used to redeem subordinated debt with par values totaling $8 million. The remaining proceeds are available for general corporate purposes.

- Citizens & Northern Bank is subject to various regulatory capital requirements. At June 30, 2021, Citizens & Northern Bank maintains regulatory capital ratios that exceed all capital adequacy requirements. Management expects the Bank to remain well-capitalized for the foreseeable future.

- Trust assets under management by C&N’s Wealth Management Group amounted to $1,192,928,000 at June 30, 2021, up 4.4% from $1,142,573,000 at March 31, 2021 and 21.1% from $984,853,000 at June 30, 2020. Fluctuations in values of assets under management reflect the impact of high recent market volatility.

Citizens & Northern Corporation is the bank holding company for Citizens & Northern Bank, headquartered in Wellsboro, Pennsylvania which operates 29 banking offices located in Bradford, Bucks, Cameron, Chester, Lycoming, McKean, Potter, Sullivan and Tioga Counties in Pennsylvania and Steuben County in New York, as well as loan production offices in Elmira, New York and York, Pennsylvania. Citizens & Northern Corporation trades on NASDAQ under the symbol “CZNC.” For more information about Citizens & Northern Bank and Citizens & Northern Corporation, visit www.cnbankpa.com.

Safe Harbor Statement: Except for historical information contained herein, the matters discussed in this release are forward-looking statements. Investors are cautioned that all forward-looking statements involve risks and uncertainty, including without limitation, the following: the effect of COVID-19 and related events, which could have a negative effect on C&N’s business prospects, financial condition and results of operations, including as a result of quarantines; market volatility; market downturns; changes in consumer behavior; business closures; deterioration in the credit quality of borrowers or the inability of borrowers to satisfy their obligations to C&N (and any related forbearances or restructurings that may be implemented); changes in the value of collateral securing outstanding loans; changes in the value of the investment securities portfolio; effects on key employees, including operational management personnel and those charged with preparing, monitoring and evaluating the companies’ financial reporting and internal controls; declines in the demand for loans and other banking services and products, as well as increases in non-performing loans, owing to the effects of COVID-19 in the markets served by C&N and in the United States as a whole; declines in demand resulting from adverse impacts of the disease on businesses deemed to be “non-essential” by governments and individual customers in the markets served by C&N; or branch or office closures and business interruptions triggered by the disease; changes in monetary and fiscal policies of the Federal Reserve Board and the U.S. Government, particularly related to changes in interest rates; changes in general economic conditions caused by factors other than COVID-19; legislative or regulatory changes; downturn in demand for loan, deposit and other financial services in the Corporation’s market area; increased competition from other banks and non-bank providers of financial services; technological changes and increased technology-related costs; changes in management’s assessment of realization of securities and other assets; and changes in accounting principles, or the application of generally accepted accounting principles. Citizens & Northern disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Refer&Reward

Refer a friend to C&N and you'll both receive a special bonus: $50 for you, $50 for them!