We're dedicated to our community.

Press Releases

Want to know what's new with us? Here's where you'll find the latest news about events, services and much more.

- Home

- About

- Explore C&N

- Press Releases

- 2021 Q2

- C&N Declares Dividend and Announces First Quarter 2021 Unaudited Financial Results

04/22/2021

C&N Declares Dividend and Announces First Quarter 2021 Unaudited Financial Results

Wellsboro, PA – Citizens & Northern Corporation (“C&N”) (NASDAQ: CZNC) announced its most recent dividend declaration and its unaudited, consolidated financial results for the three-month period ended March 31, 2021.

Dividend Declared

On April 22, 2021, C&N’s Board of Directors declared a regular quarterly cash dividend of $0.28 per share. The dividend is payable on May 14, 2021 to shareholders of record as of May 3, 2021. The amount is increased 3.7% from the previous quarterly dividend of $0.27 per share which was paid in February 2021.

Unaudited Financial Information

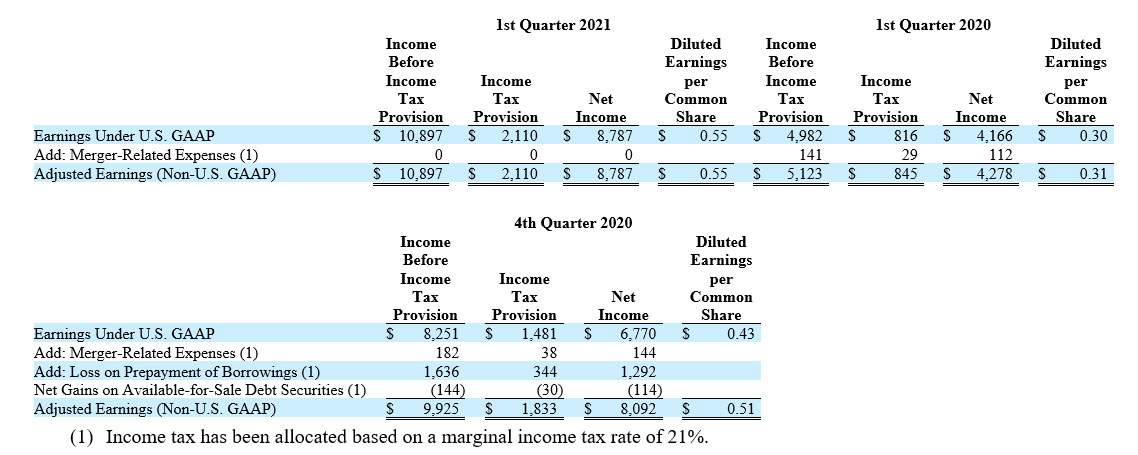

Net income was $0.55 per diluted share in the first quarter 2021, up $0.12 (27.9%) from $0.43 in the fourth quarter 2020 and up $0.25 (83.3%) from $0.30 in the first quarter 2020. As described below, earnings of $0.55 per share for the first quarter 2021 were 7.8% higher than fourth quarter 2020 non-U.S. GAAP earnings per share of $0.51 as adjusted to exclude the impact of merger-related expenses, loss on prepayment of borrowings and net gains on available-for-sale debt securities. First quarter 2021 earnings per share were 77.4% higher than first quarter 2020 non-U.S. GAAP earnings per share of $0.31 as adjusted to exclude the impact of merger-related expenses.

The following table provides a reconciliation of C&N’s unaudited earnings results under U.S. generally accepted accounting principles (U.S. GAAP) to comparative non-U.S. GAAP results excluding merger-related expenses, loss on prepayment of borrowings and net gains on available-for-sale debt securities. Management believes disclosure of unaudited earnings results for the periods presented, adjusted to exclude the impact of these items, provides useful information to investors for comparative purposes.

RECONCILIATION OF UNAUDITED U.S. GAAP NET INCOME AND

DILUTED EARNINGS PER SHARE TO NON-U.S. GAAP MEASURE

(Dollars In Thousands, Except Per Share Data)

(Unaudited)

Acquisition of Covenant Financial, Inc.

On July 1, 2020, C&N completed its acquisition of Covenant Financial, Inc. (“Covenant”). Covenant was the holding company for Covenant Bank, which operated banking offices in Bucks and Chester Counties of Pennsylvania. The Covenant acquisition has contributed significantly to growth in the size of C&N’s balance sheet and in net interest income and noninterest expenses.

In connection with the transaction, C&N recorded goodwill of $24.1 million and a core deposit intangible asset of $3.1 million. Total loans acquired on July 1, 2020 were valued at $464.2 million, while total deposits assumed were valued at $481.8 million, borrowings were valued at $64.0 million and subordinated debt was valued at $10.1 million. The Corporation acquired available-for-sale debt securities valued at $10.8 million and bank-owned life insurance valued at $11.2 million.

Merger-related expenses related to the planned acquisition of Covenant totaled $141,000 in the first quarter 2020.

Highlights related to C&N’s first quarter unaudited U.S. GAAP earnings results as compared to the fourth quarter 2020 and comparative period of 2020 are presented below.

First Quarter 2021 as Compared to Fourth Quarter 2020

Net income was $8,787,000, or $0.55 per diluted share, for the first quarter 2021, up from $6,770,000, or $0.43 per diluted share, in the fourth quarter 2020. Adjusted (non-U.S. GAAP) earnings for the fourth quarter 2020, excluding the effects of merger-related expenses, loss on prepayment of borrowings and net realized gains on securities, were $0.51 per share. Other significant variances were as follows:

- Net interest income totaled $20,083,000 in the first quarter 2021, up $328,000 from the fourth quarter 2020 amount of $19,755,000. Significant variances included the following:

- Total interest and fees from loans originated under the U.S. Small Business Administration (SBA) Paycheck Protection Program (PPP) were $1,998,000 in the first quarter 2021, an increase of $503,000 over the fourth quarter 2020 total. This increase in income from PPP loans resulted from accelerated recognition of origination fees based on the SBA’s repayment of loans tied to the forgiveness of the underlying borrowers. Total fee income from PPP loans amounted to $1,645,000 in the first quarter 2021 (included in the $1,998,000 noted above) and $1,099,000 in the fourth quarter 2020.

- Accretion and amortization of purchase accounting adjustments had a net positive impact on net interest income of $952,000 in the first quarter 2021 as compared to a net positive impact of $1,273,000 in the fourth quarter 2020.

- Average loans outstanding totaled $1.635 billion in the first quarter 2021, down $35.0 million from the prior quarter, including a $13.9 million decrease in average PPP loans as well as decreases in other commercial loans and residential mortgage loans. The reduction in average residential mortgage loans outstanding reflects a greater proportion of residential mortgage loans originated being sold on the secondary market.

- Average total deposits decreased $14.5 million, including a decrease in average time deposits of $45.7 million. Average total borrowed funds decreased $54.1 million, including the impact of prepaying long-term borrowings in the fourth quarter 2020.

- The net interest rate spread increased 0.26%, as the average yield on earning assets increased 0.18% while the average rate on interest-bearing liabilities decreased 0.08%. The net interest margin was 4.00% in the first quarter 2021, up from 3.76% in the fourth quarter 2020.

- The provision for loan losses was $259,000 in the first quarter 2021, a decrease in expense of $361,000 from the fourth quarter 2020 provision of $620,000. The first quarter provision included a net charge of $182,000 related to specific loans (increase in specific allowances on loans of $199,000, partially offset by net recoveries of $17,000), an increase of $92,000 in the unallocated portion of the allowance and a credit of $15,000 attributable to decreases in the collectively determined portion of the allowance for loan losses.

- Noninterest income was $6,782,000 in the first quarter 2021, up $217,000 from the fourth quarter 2020 amount. Significant variances included the following:

- Other noninterest income totaled $1,472,000, an increase of $700,000 from the fourth quarter total including an increase in income from tax credits of $765,000. The increase in income from tax credits included the 90% credits on the higher amount of PA Educational Improvement Tax Credit Program donations noted below.

- Net gains from sales of loans totaled $1,064,000 in the first quarter 2021, a decrease of $408,000 from the fourth quarter total. The volume of residential mortgage loans sold in the first quarter 2021 was high by C&N’s historical standards, though down from the fourth quarter 2020.

- Service charges on deposit accounts totaled $1,015,000, a decrease of $90,000 from the fourth quarter total as the volume of consumer overdraft activity fell.

- Noninterest expense, excluding merger-related expenses and loss on prepayment of borrowings, of $15,709,000 decreased $66,000 in the first quarter 2021 from the fourth quarter 2020 amount. Significant variances included the following:

- Salaries and employee benefits of $8,895,000 decreased $1,103,000 from the fourth quarter 2020 total, as fourth quarter 2020 incentive compensation expense increased based on an updated comparison of C&N’s 2020 earnings performance to peers and fourth quarter COVID-19 related compensation costs.

- Other noninterest expense of $2,755,000 increased $697,000 from the fourth quarter total, reflecting an increase in donations of $781,000 relating to the PA Educational Improvement Tax Credit Program.

- Professional fees increased $120,000 related to recruiting services and SBA processing professional fees.

- Net occupancy and equipment expense increased $110,000 from the fourth quarter total, including seasonal increases in snow removal and fuel costs.

- The income tax provision was $2,110,000 for the first quarter 2021, up from $1,481,000 for the fourth quarter 2020. The increase in income tax provision reflected the increase in pre-tax income of $2,646,000 for the quarter.

First Quarter 2021 as Compared to First Quarter 2020

As described above, first quarter 2021 net income was $8,787,000. In comparison, first quarter 2020 net income was $4,166,000, and excluding merger-related expenses, adjusted (non-U.S. GAAP) earnings were $4,278,000. Other significant variances were as follows:

- First quarter 2021 net interest income of $20,083,000 was $5,801,000 higher than the first quarter 2020 total, reflecting the impact of growth mainly attributable to the Covenant acquisition. Average outstanding loans increased $466.1 million, and average total deposits increased $570.9 million. The net interest margin for the first quarter 2021 was 4.00% as compared to 3.83% for the first quarter 2020. The average yield on earning assets of 4.33% for the first quarter 2021 was down 0.22% from the first quarter 2020, while the average rate on interest-bearing liabilities of 0.47% in the first quarter 2021 was 0.54% lower than the comparable first quarter 2020 average rate. Accretion and amortization of purchase accounting adjustments had a net positive impact on net interest income of $952,000 in the first quarter 2021 as compared to a net positive impact of $417,000 in the first quarter 2020.

- The provision for loan losses was $259,000 in the first quarter 2021 as compared to $1,528,000 in the first quarter 2020. Details concerning the first quarter 2021 provision for loan losses were described previously. In the first quarter 2020, the provision included the effects of recording a specific allowance of $1,193,000 on a commercial loan for which a charge-off of $2,219,000 was subsequently recorded in the third quarter 2020.

- Noninterest income for the first quarter 2021 was up $1,501,000 from the first quarter 2020 total. Significant variances included the following:

- Net gains from sales of loans of $1,064,000 for the first quarter 2021 were up $749,000 from the total for the first quarter 2020. The increase reflects an increase in volume of mortgage loans sold, due mainly to the impact of historically low interest rates on the housing market and refinancing activity.

- Other noninterest income totaled $1,472,000, an increase of $411,000 from the first quarter 2020. Income from tax credits of $765,000, an increase of $262,000 compared to the first quarter 2020, was due to higher PA Educational Improvement Tax Credit Program donations. In the first quarter 2021, fee income for providing credit enhancement on sale of mortgage loans increased $100,000 and income from a full-service title agency acquired from Covenant increased $47,000.

- Loan servicing fees, net, were $248,000 in the first quarter 2021, an increase of $262,000 over the first quarter 2020 total. The fair value of servicing rights increased $75,000 in the first quarter 2021 as compared to a reduction in fair value of $126,000 in the first quarter 2020.

- Interchange revenue from debit card transactions totaled $881,000 in the first quarter 2021, an increase of $150,000 over the first quarter 2020 total.

- Trust revenue of $1,626,000 increased $147,000 reflecting the impact of growth in trust assets under management including the impact of market value appreciation.

- Service charges on deposit accounts of $1,015,000 in the first quarter 2021 were down $235,000 from the first quarter 2020 amount, as the volume of consumer and business overdraft activity fell.

- Noninterest expense, excluding merger-related expenses, increased $2,797,000 in the first quarter 2021 over the first quarter 2020 amount. Significant variances included the following:

- Salaries and employee benefits of $8,895,000 increased $1,517,000, reflecting an increase in personnel due to the Covenant acquisition.

- Other noninterest expense increased $646,000. Within this category, donations increased $279,000 relating to the PA Educational Improvement Tax Credit Program, FDIC insurance increased $140,000, other operational losses totaling $123,000 increased $83,000, amortization of core deposit intangibles increased $72,000 related to the Covenant acquisition, and the provision for credit losses on mortgage loans sold with credit enhancement increased $60,000.

- Net occupancy and equipment expense increased $201,000, primarily reflecting an increase due to the Covenant acquisition.

- Professional fees increased $168,000 related to recruiting services and SBA processing professional fees.

- Data processing and telecommunications expenses increased $156,000, including the impact of growth related to the Covenant acquisition, increased costs from outsourced support services and other increases in software licensing and maintenance costs.

- The income tax provision of $2,110,000 for the first quarter 2021 was up $1,294,000 from $816,000 for the first quarter 2020, reflecting higher pre-tax income.

Other Information:

Changes in other unaudited financial information are as follows:

- Total assets amounted to $2,333,595,000 at March 31, 2021, up from $2,239,100,000 at December 31, 2020 and up 43.2% from $1,629,445,000 at March 31, 2020.

- Net loans outstanding (excluding mortgage loans held for sale) were $1,602,924,000 at March 31, 2021, down from $1,632,824,000 at December 31, 2020 and up 38.6% from $1,156,143,000 at March 31, 2020. In comparing outstanding balances at March 31, 2021 and 2020, total commercial loans were up $428.1 million (75.2%), including PPP loans of $137.8 million, total residential mortgage loans were higher by $19.6 million (3.4%) and total consumer loans were down $0.6 million (3.7%). The outstanding balance of residential mortgage loans originated and serviced by C&N that have been sold to third parties was $295.5 million at March 31, 2021, up $113.1 million (62.0%) from March 31, 2020.

- The recorded investment in PPP loans at March 31, 2021 of $137.8 million included a first draw amount of $71.7 million and a second draw amount of $66.1 million with contractual principal balances totaling $73.0 million and $69.0 million, respectively, adjusted by net deferred loan origination fees and a market rate adjustment on PPP loans acquired from Covenant. The recorded investment of $71.7 million in first draw PPP loans at March 31, 2021 decreased $60.6 million from $132.3 million at December 31, 2020, reflecting the impact of loans forgiven and repaid by the SBA. The term of the first draw PPP loans is two years, with repayment from the SBA to occur sooner to the extent the loans are forgiven. Second draw PPP loans have terms of five years, with repayment from the SBA to occur sooner to the extent the loans are forgiven.

- To work with clients impacted by COVID-19, C&N is offering short-term loan modifications (deferrals) on a case-by-case basis to borrowers who were current in their payments prior to modification. These loans are not reported as past due or troubled debt restructurings during the deferral period. At March 31, 2021, there were 25 loans, with an aggregate recorded investment of approximately $26.0 million, in deferral status under the program. In comparison, at December 31, 2020, C&N had 45 loans with an aggregate recorded investment of $37.4 million in deferral status. Within these totals, loans in deferral status to commercial borrowers in the hotel industry totaled $19.5 million at March 31, 2021 and $25.1 million at December 31, 2020.

- Total nonperforming assets as a percentage of total assets was 1.07% at March 31, 2021, down from 1.10% at December 31, 2020 and up from 0.99% at March 31, 2020. Total nonperforming assets were $24.9 million at March 31, 2021 and $24.7 million at December 31, 2020.

- The allowance for loan losses was $11.7 million at March 31, 2021, or 0.72% of total loans as compared to $11.4 million or 0.69% of total loans at December 31, 2020. In 2020 and 2019, C&N recorded performing loans purchased from other financial institutions at fair value. The calculations of fair value included discounts for credit losses, reflecting an estimate of the present value of credit losses based on market expectations. The total allowance for loan losses and the credit adjustment on purchased non-impaired loans at March 31, 2021 was $16.8 million, or 1.04% of total loans receivable and the credit adjustment. The comparative ratios were 1.05% at December 31, 2020 and 1.06% at March 31, 2020.

- Deposits totaled $1,923,925,000 at March 31, 2021, up from $1,820,469,000 at December 31, 2020, and up 53.9% from $1,249,912,000 at March 31, 2020. The increase in deposits at March 31, 2021 included the effects of PPP-related increases, U.S. government stimulus funding and other factors.

- Total stockholders’ equity was $300,056,000 at March 31, 2021, up from $299,756,000 at December 31, 2020 and $251,228,000 at March 31, 2020. The increase in stockholders’ equity from March 31, 2020 included the impact of common stock issued in July 2020 related to the Covenant acquisition. Within stockholders’ equity, the portion of accumulated other comprehensive income related to available-for-sale debt securities was $6,847,000 at March 31, 2021, down from $11,676,000 at December 31, 2020 and $9,230,000 at March 31, 2020. Fluctuations in accumulated other comprehensive income related to valuations of available-for-sale debt securities have been caused by changes in interest rates.

- Citizens & Northern Bank is subject to various regulatory capital requirements. At March 31, 2021, Citizens & Northern Bank maintains regulatory capital ratios that exceed all capital adequacy requirements. Management expects the Bank to remain well-capitalized for the foreseeable future.

- Trust assets under management by C&N’s Wealth Management Group amounted to $1,142,573,000 at March 31, 2021, up 3.6% from $1,103,228,000 at December 31, 2020 and 31.4% from $869,636,000 at March 31, 2020. Fluctuations in values of assets under management reflect the impact of high recent market volatility.

Citizens & Northern Corporation is the bank holding company for Citizens & Northern Bank, headquartered in Wellsboro, Pennsylvania which operates 29 banking offices located in Bradford, Bucks, Cameron, Chester, Lycoming, McKean, Potter, Sullivan and Tioga Counties in Pennsylvania and Steuben County in New York, as well as loan production offices in Elmira, New York and York, Pennsylvania. Citizens & Northern Corporation trades on NASDAQ under the symbol “CZNC.” For more information about Citizens & Northern Bank and Citizens & Northern Corporation, visit www.cnbankpa.com.

Refer&Reward

Refer a friend to C&N and you'll both receive a special bonus: $50 for you, $50 for them!